The Board of Directors of the ACPMP Research Foundation want donors to have the highest level of confidence when making contributions to the Foundation.

It is our intention to provide you with that confidence by sharing the following information. If you have any questions or concerns, please don't hesitate to email any of our Board Members or our general e-mail info@acpmp.org.

ACPMP is an IRS-designated 501(c)3 charitable organization. Our EIN is 26-2890160.

IRS Determination Letter granting 501(c)3 designation

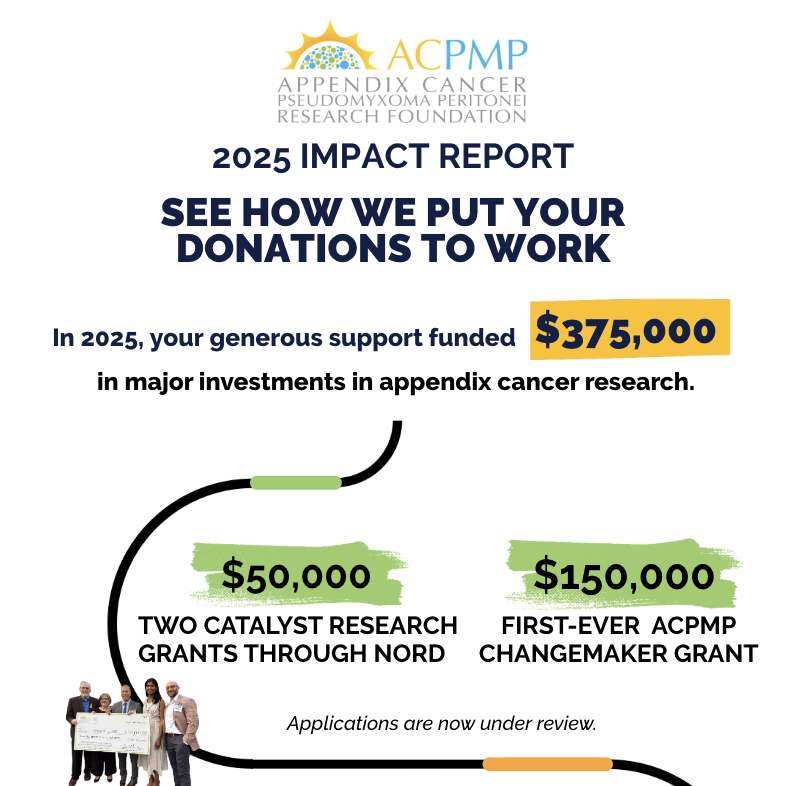

2025 Impact Report

2024 IRS 990 coming soon

2024 Impact Report

2023 IRS 990

2023 Reviewed Financial Statements

2023 ACPMP Impact Report

2022 IRS 990

2022 Reviewed Financial Statements

2021 IRS 990

2021 Reviewed Financial Statements

2020 IRS 990

2020 Reviewed Financial Statements

2019 IRS 990

2019 Reviewed Financial Statements

2019 Impact Report

2018 Impact Report

Older Financials

ACPMP is proud to be a Platinum Level Participant on the GuideStar Exchange, demonstrating our commitment to financial transparency.

ACPMP has also earned a “Give with Confidence” 3 STAR Rating From Charity Navigator.

In addition to complying with all IRS filing requirements, ACPMP operates under the following accounting and operational control procedures to manage the Foundation's assets:

Segregation of Duties: One individual processes donations, adds donor information to our database, and sends out an acknowledgement of the donation to the donor for tax purposes. A separate individual makes the bank deposits. The Foundation also utilizes an accounting department where personnel have separate responsibilities with respect to processing and recording of financial activity. The accounting department prepares internal financial statements which are subject to oversight and review by the Finance Committee. In addition to the financial statements, the bank statements and donor database are made available to the Foundation’s Finance Committee. Annually, the Foundation’s financial statements are reviewed by an independent CPA firm that also prepares the Foundation’s IRS Form 990. The 990 is reviewed in detail by the Finance Committee and approved by the Board prior to filing.

Conflict of Interest Policy: The Board of Directors has adopted an IRS recommended, but not required, Conflict of Interest Policy wherein they agree that they will neither benefit individually nor from a business perspective when conducting Foundation business.

Compliance with FASB Accounting Rules: The Foundation utilizes an industry standard accounting software for small organizations. All records are reviewed regularly by our CPA.

Safe, Secure Payment Processor: The Foundation selected a webhost that processes all online donations through Paypal, the most trusted, largest and most cost-effective processor of online payments in the U.S. No financial information is processed or retained on our website.

Investment Policy: Our Board of Directors has adopted an Investment Policy recommended by our Finance Committee that provides for prudent investment of the Foundation’s assets.